AIBE Explainer Series

The AIBE Explainer series provides a breakdown of some of the key economic issues facing Australians today. This explainer has been written by our Director Professor Flavio Menezes and by the Summer Research Scholar Gustavo A. Martínez Tello.

Hydrogen's role in the renewable energy transition

There is a great deal of uncertainty about the role that green hydrogen will play during and beyond the energy transition. Its success as an alternative fuel over the next decade relies on the realisation of cost reductions and policy settings, such as the introduction of carbon tariffs – a tax on carbon-intensive imports. The long-run prospects seem more certain, as we will need lots of ways to store and use electricity during time when there will be significant excess generation from renewables.

In this AIBE Explainer, we outline the local and global policy context for the future of hydrogen in Australia and current investment in hydrogen projects nationally.

How energy policy is affecting the transition

It is estimated that the Australian hydrogen industry could be worth between $50 to $130 billion by 2050. In the context of underlying technological and policy uncertainty, governments are playing an active role in the development of this new industry. In Australia, a main governmental goal is to reduce the cost of green hydrogen including through its support of industrial hubs and enabling infrastructure such as refuelling stations. The National Hydrogen Strategy aims to create clusters to scale the production of hydrogen, develop pilots in the short term, and review the regulatory legal framework to promote an attractive investment environment, safety standards, and workforce training. Hydrogen fuel is among the low-emissions technologies that were allocated over A$1 billion in the 2022-2023 federal budget, including A$300 million for producing clean hydrogen, along with liquefied natural gas, in Darwin.

The Australian government’s support for the green hydrogen industry, and more broadly for the energy transition pales in comparison to that of major economies though. For example, the Inflation Reduction Act in the US aims to reduce production costs by including a production tax credit of $4.4/kg. The Act sets aside $540 billion for energy security and climate change programs over the next decade. Europe’s Green Deal Industrial Plan proposed financing comprises of two main streams totalling $1.5 trillion. Japan’s Green Transformation Plan aims to raise up to $280 billion via ‘green transition’ bonds. The UK, Canada and many others have also put forward their investment plans in clean technologies. Many of these initiatives are, at least partly, responding to China’s dominance in the manufacturing of net-zero technologies on the back of large subsidies. China’s pipeline of announced investments in clean technologies under its Five-Year Plan exceeds $400 billion.

These very large initiatives will further distort markets. It is a return to industrial policies that favour particular industries. Such policies were largely abandoned since the world trade liberalisation of the mid-eighties in favour of economy-wide market governance and regulatory arrangements aimed at ensuring that efficient domestic firms could compete in the Australian and international markets. The support of the Australian government for green hydrogen production ought to be seen in this global context where the governments of all major economies are involved. The aspiration is that we become a major producer and exporter of green hydrogen.

Hydrogen in the global energy market

The current demand for hydrogen is concentrated in refineries, and in the production of ammonia, methanol, and steelmaking. The demand from sectors such as construction, transport or energy represented less than 1% of the total demand, which reached 94Mt in 2021. The International Energy Agency estimates that the total hydrogen demand will be around 180Mt in 2030, with nearly half dedicated to heavy industry, power generation, and hydrogen-based fuels. By 2070, the IEA estimates that demand will reach over 500 Mt. While renewable capacity to generate hydrogen is expected to be concentrated in China, Australia has a pipeline of solar and onshore wind projects to reach almost 6.5GW of electricity and will be capable of generating nearly 144 tonnes of green hydrogen.

Green Hydrogen in Australia

CSIRO, Australia’s national science research agency, maintains an updated list of hydrogen projects in Australia. Information gathered includes the main proponent, main end-use, status, location, energy source, and estimated production. As of February of 2023, there are 101 green hydrogen projects listed:

Table 1: Green hydrogen projects in Australia (2023)

| State/Territory | In development | Construction phase | Operational | Total number of projects |

|---|---|---|---|---|

| Queensland | 23 | 4 | 1 | 28 |

| Western Australia | 22 | 5 | 1 | 28 |

| Victoria | 8 | 3 | 1 | 12 |

| Tasmania | 10 | - | - | 10 |

| New South Wales | 6 | 2 | 1 | 9 |

| South Australia | 1 | - | 7 | 8 |

| Northern Territory | 3 | - | - | 3 |

| ACT | - | - | 2 | 2 |

| Total | 73 | 14 | 13 | 101 |

Source: CSIRO, HyResource, 2023

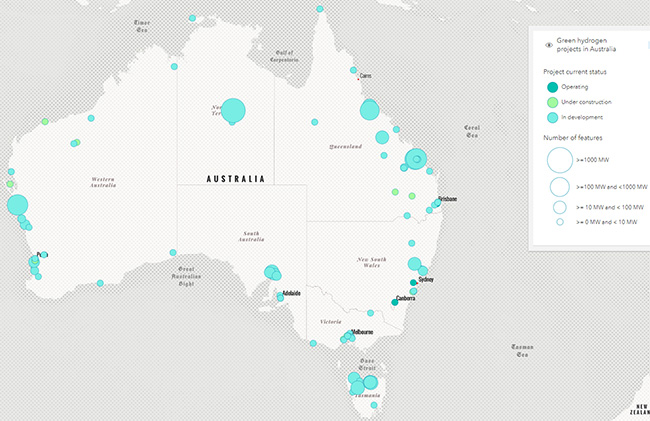

Only 7% of the projects listed above are operating and less than 15% are in construction. The large majority (79%) of projects under development include those as that are waiting for the conclusion of environmental assessment, licensing, design, or bidding. It also includes project that are still in the planning phase and memorandums of understanding. Almost 50% of the projects do not include the electrolyser size. Of the projects that do include electrolyser size, less than 20% have electrolysers that are larger than 10MW. The interactive map below shows all information available for each of the listed projects. It is an impressive list, and Australia’s green hydrogen production could reach an electrolyser capacity of nearly 50 GW by 2030. However, significant uncertainty remains, both about costs and technological improvements, but also about resources.

Figure 2: Map of green hydrogen production in Australia

Source: CSIRO. Map created with the assistance of César Moreno.

In addition to the projects listed above, there is also funding from the federal government for the establishment of hydrogen hubs in regions where users of hydrogen across industrial, transport and energy markets are co-located. The existing seven hub implementation grants add up to up to $431 million. Existing development and design grants total $23 million:

A further $71.9 million for a green hydrogen hub in Townsville in the 2022-2023 Federal Budget. Most state and territory hydrogen strategies also include the goal of developing a hydrogen industry (or its use as an energy source) out to 2030. With the exception of the Northern Territory and the ACT, all plans include financial incentives. Some of the jurisdictions, however, do not clearly distinguish between blue and green hydrogen, and refer to 'renewable' hydrogen.

The investment – actual and projected – in green hydrogen in Australia illustrates our national aspirations to realise its environmental potential and to participate actively in the growing global investment economy around energy transitions. The Australian Government is playing a key role in driving investment, but a deeper dive into Australia’s green hydrogen project pipeline shows uncertainty about how and when these aspirations might be realised.

Fair, promising and feasible futures

At the Australian Institute for Business and Economics, we work with partners in business and government toward fair, promising and feasible futures. Learn more about us.

If you have any suggestions for future explainers, contact us at aibe@uq.edu.au.